人生如梦、股市波动大。。。SIMPLE LIFE IS THE BEST

LIFE IS BUT A DREAM 人生如梦 LIFE IS BUT A DREAM 人生如梦 LIFE IS BUT A DREAM 人生如梦

Monday, September 28, 2020

Thursday, September 10, 2020

Monday, September 7, 2020

Thursday, September 3, 2020

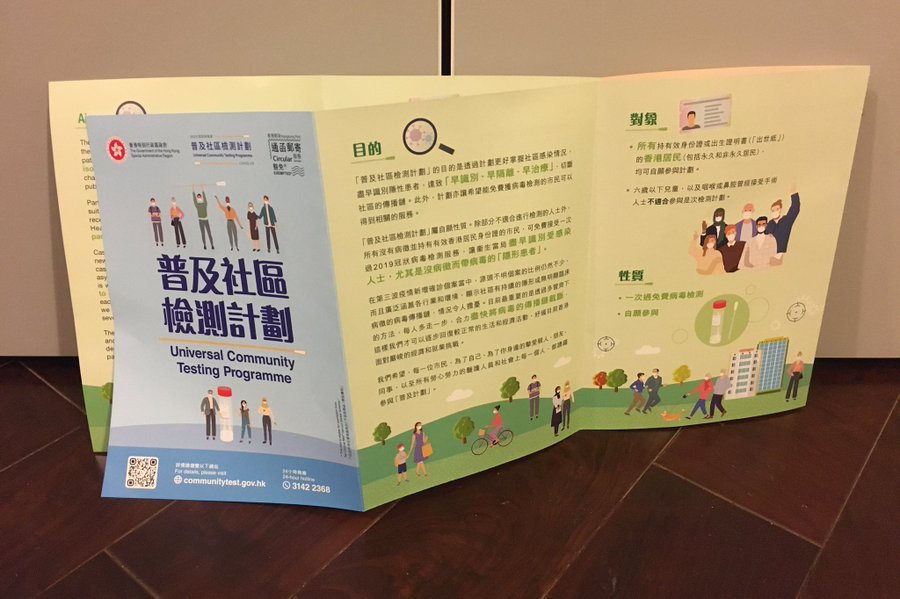

COVID-19---HONG KONG GO FOR MASS VIRUS TESTING, 917000 PEOPLE BOOKED

Hong Kong gov to extend city-wide mass virus testing for four days, as more than 520,000 tested, and 917,000 booked tests

兩日半驗13.8萬樣本 新症僅兩宗

全民檢測推展兩日半以來,只檢測到近十四萬個樣本,

不及華昇診斷中心早前表示每日檢測三十萬個檢測量的一半,

而且當中只找到兩個新確診個案,

比政府當初預期每五千人有一名隱形病人為低,惹人質疑計劃成效差。

政府專家顧問、香港大學微生物學系講座教授袁國勇坦言,相關結果屬預期之內,但不要看重能找出多少位確診患者,「捉到好過捉唔到」;又預料冬季會出現第四波疫情,藉今次全民檢測作好演練,為第四波疫情做好準備。

截至昨晚八時,超過八十八萬人登記進行檢測,四十七萬人已採樣,檢測中心完成十三萬八千個樣本化驗,當中有六個樣本呈陽性,證實確診。

衞生防護中心傳染病處主任張竹君說,六宗個案中,有四宗是舊個案,即已出院康復,再驗出確診估計是體內殘餘病毒所致。她指其中三人出院後想再化驗,另一人因上班原因,公司希望他有陰性報告。四人均無病徵,並有抗體,病毒數值介乎廿七至三十六,顯示病毒量低,估計沒有傳染性,亦不屬二次感染,他們已康復。

對於檢測量低,衞生署署長陳漢儀解釋,化驗所在運作初期需時磨合,估計化驗人員熟習流程後,速度會提升。有市民重複登記檢測,她呼籲市民,除非是高危群組,否則無必要重複檢測。部分檢測中心昨起增加名額,她呼籲市民根據登記時段接受採樣,避免即場登記,減低輪候時間。

另外,將軍澳醫院表示,昨日在寶寧路普通科門診門外發生遺失深喉唾液樣本集收箱事件,閉路電視記錄是一名在診所取藥的年長男子取走,聯絡該男子後,他承認曾取走該集收箱,其後棄置在厚德邨停車場。

警方昨晚七時四十五分在厚德邨停車場尋回集收箱並交回診所。診所呼籲昨日曾將唾液樣本交到上址的市民,致電21911083查詢補交樣本安排。