LIFE IS BUT A DREAM 人生如梦 LIFE IS BUT A DREAM 人生如梦 LIFE IS BUT A DREAM 人生如梦

Wednesday, March 27, 2019

Tuesday, March 26, 2019

Armada ... STILL WORRYING AND ALARMING...'Downside Risk' Despite Nearing Loan Agreement.

Despite nearing a US$500mil (RM2.03bil) loan deal, Streets reckon Armada’s downside risk is growing, with deteriorating fundamentals from both floating production storage and offshore (FPSO) and offshore marine services (OMS) segments.

The fundamental drag on Bumi Armada is its Ebitda deterioration from the OMS segment. This is even if the FPSO earnings stabilise.

At the least, the group must replenish the OMS contracts and return to profitability, as well as resolve the uncertainties of loan refinancing to support upside catalysts for the stock.

Overall, concerned are still over the group’s long-term ability to repay loans.

Streets estimated that out of Bumi Armada’s RM10bil loans, about RM6bil to RM7bil are project loans for the FPSO segment, while the remainder of more than RM4bil are unsecured loans that were likely incurred to support the group’s expansion in the OMS segment. The OMS segment comprises offshore support vessels and subsea construction vessels.

On 25 March 2019 it was reported that Bumi Armada was nearing an agreement for a US$500mil loan, which will give the energy firm more time to sell assets and restructure its business in a bid to return to profitability.

Banks are reported to be finalising a five-year credit facility and Bumi Armada is expected to sign the loan agreement with lenders. The funds will be used to refinance debts that are maturing in May 2019 and for working capital.

Bumi Armada has an immediate RM1.5bil of unsecured term loans that needs to be refinanced and the guidance for a refinancing outcome had been delayed several times to the second quarter of 2019.

This brought many uncertainties in the market, as to whether the company may have to resort to an unfavourable outcome of a rights issue or default on its loans.

Additionally, Bumi Armada is seeking a solution with the sukuk holders for the RM1.5bil of sukuk murabahah which had its covenant breached, while the RM1.8bil project loan for Kraken is also facing problems on poor Ebitda generation.

At RM0.19 its share price remains expensive versus the risk, trading at more than 10 times enterprise value to Ebitda (EV/Ebitda), in view that the Ebitda generation of the relevant businesses is still declining.

Monday, March 25, 2019

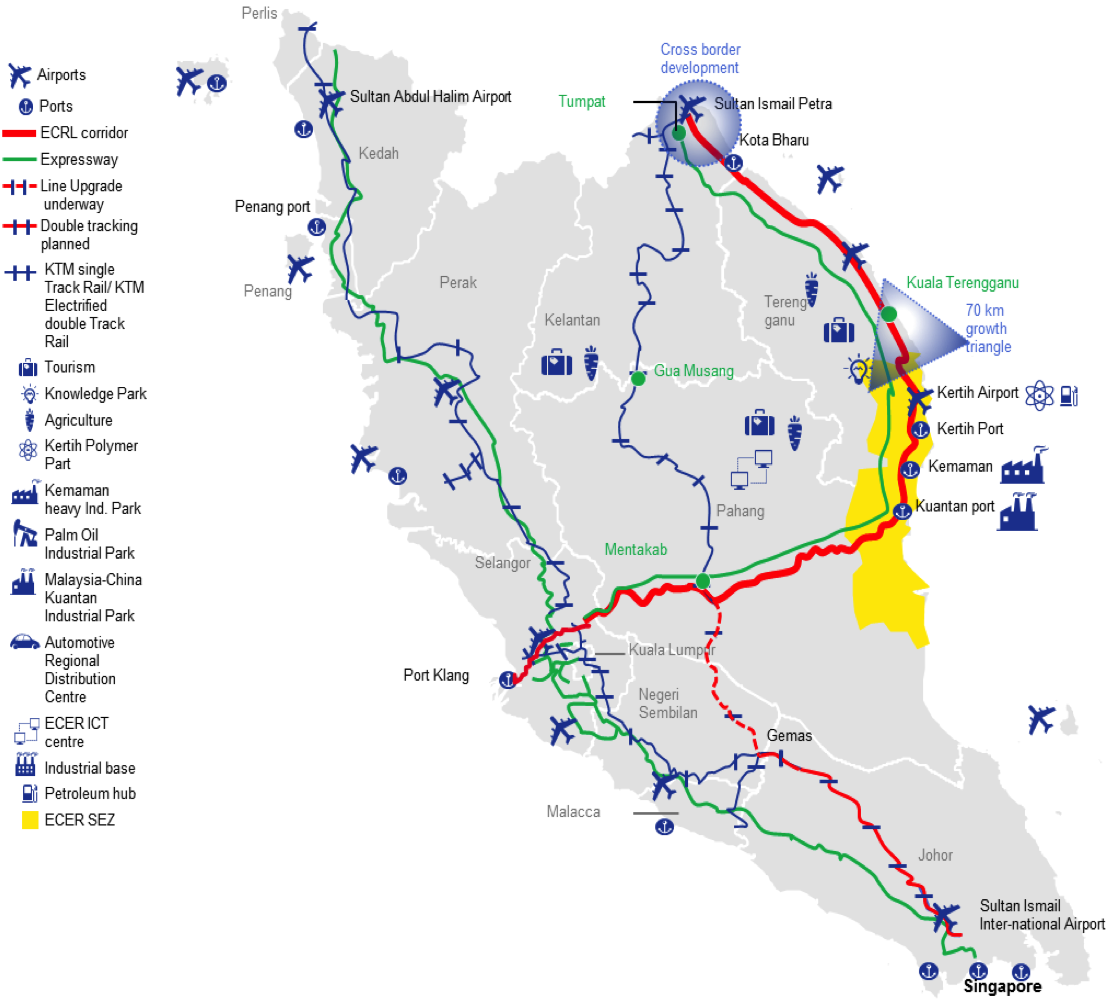

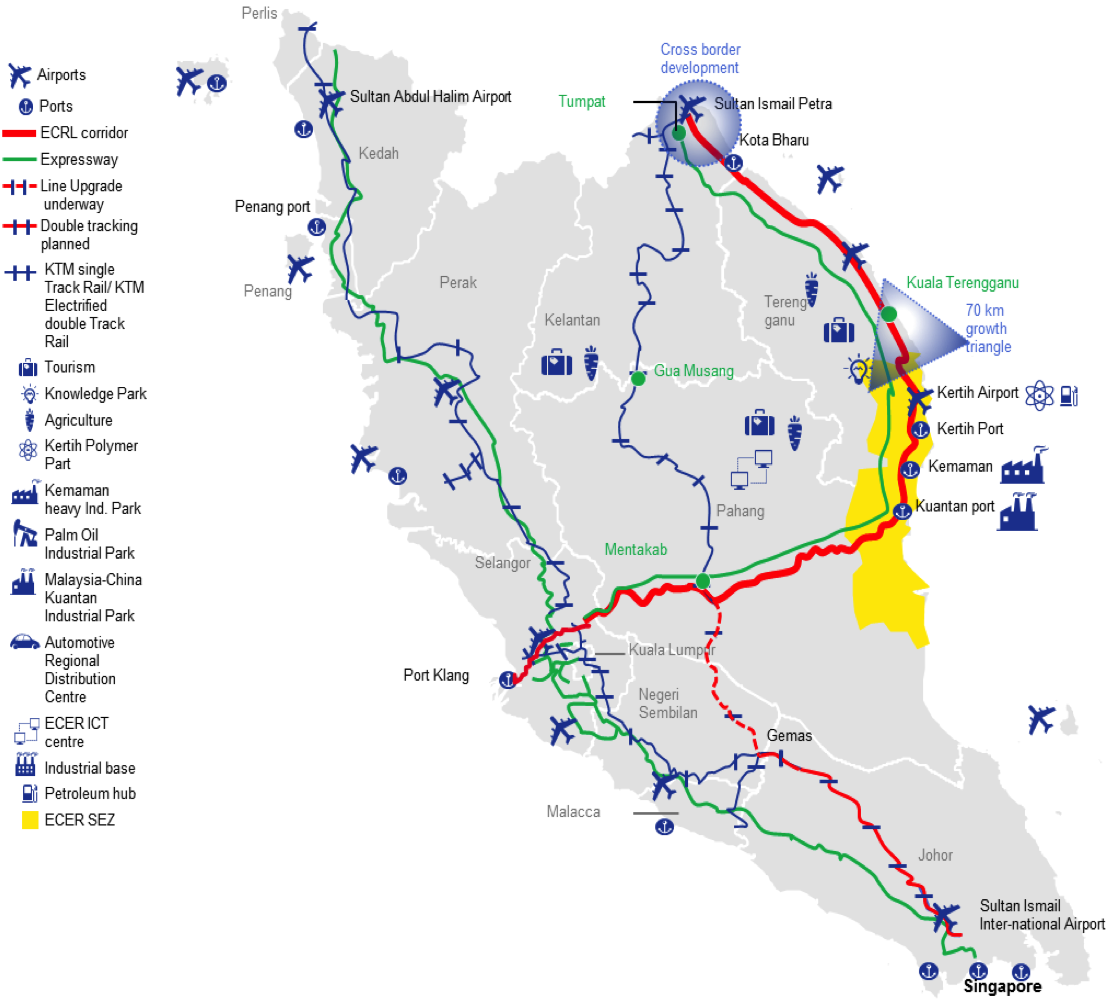

PROPERTY MARKET FOR PAHANG WILL BE BOOSTED,AND PASDEC WILL BE TOP BENEFICIARY.

东铁是一个必须的 PROJECT,因为这个东海岸的交通运输不能够只靠目前不完善的公路。。。。

发展东海岸已经是必须,也无法逃避的事项。

发展的海岸对霹雳州和柔佛州有利,可以带动多个州的互动发展。当然, 彭亨州的土地价格将会上涨。有土地的个人、社团、公司和州政府机构,将会因土地价格上升,也获得很好的报酬。

东铁工程--受益的也是彭亨州人及东海岸的朋友们。

也就是说,有土地的个人、社团、公司和州政府机构,将会因土地价格上升,也获得很好的报酬。

州政府机构因为拥有最多土地,会是最大受益者之一。

私人界到彭亨及吉兰丹投资的机会将增加。旅游业和商业活动会增加,方便快捷肯定将让旅游更方便容易。

外资会把握机会增加投资活动会。

有关当局应该先完成彭亨州路线。。。先通车方便人民,解决鹅麦、云顶到关丹逢星期六、日及大节日(公共假期)就面对大塞车,车流量过高的问题。

兴建新山关丹大道也是时候了,是吸引新加坡人 到东海岸的方法之一。

是时候,考虑考虑东海岸土地发展的时候了。

MORE INVESTORS WILLGO TO PAHANG.....STATE ENTITIES(ENTITY) OF PAHANG......PLUS OTHERS WILL BE WINNERS

SO THEIR REAL ESTATE LANDS & ASSETS WILL APPRECIATE IN VALUE--

(IF REVALUED THEIR NTA WILL GO UP)

Possible the biggest beneficiary, OF COURSE

IS THE big landowners in that area. VALUE OF PROPERTIES IN KUANTAN WILL BE GOOD.

PROPERTY MARKET FOR PAHANG WILL BE BOOSTED,AND PASDEC WILL BE TOP BENEFICIARY.

CONTRACTORS AND SUB-CON

WILL NOT UNTUNG MUCH

BECAUSE ECRL - If restarted, will be at a much much lower price.

MARGINS WILL BE LOWER, FURTHER .......GOVERNMENT MAY WANT MORE SUB-CON TO BE INVOLVED,SO MORE SUB-CON FROM EVERY STATE WILL GET A PIECE OF CAKE

THE DISTRIBUTION OF WORKS WILL BE MORE :"FAIRLY"...AS ALL WILL GET SOME "FOODS" IN THIS BIG PROJECT.

Those companies who were in the front running for the ECRL scraps before, may ......NOT BE SELECTED...OR NO LONGER GET THE OPPORTUNITY?

发展东海岸已经是必须,也无法逃避的事项。

发展的海岸对霹雳州和柔佛州有利,可以带动多个州的互动发展。当然, 彭亨州的土地价格将会上涨。有土地的个人、社团、公司和州政府机构,将会因土地价格上升,也获得很好的报酬。

东铁工程--受益的也是彭亨州人及东海岸的朋友们。

也就是说,有土地的个人、社团、公司和州政府机构,将会因土地价格上升,也获得很好的报酬。

州政府机构因为拥有最多土地,会是最大受益者之一。

私人界到彭亨及吉兰丹投资的机会将增加。旅游业和商业活动会增加,方便快捷肯定将让旅游更方便容易。

外资会把握机会增加投资活动会。

有关当局应该先完成彭亨州路线。。。先通车方便人民,解决鹅麦、云顶到关丹逢星期六、日及大节日(公共假期)就面对大塞车,车流量过高的问题。

兴建新山关丹大道也是时候了,是吸引新加坡人 到东海岸的方法之一。

是时候,考虑考虑东海岸土地发展的时候了。

MORE INVESTORS WILLGO TO PAHANG.....STATE ENTITIES(ENTITY) OF PAHANG......PLUS OTHERS WILL BE WINNERS

SO THEIR REAL ESTATE LANDS & ASSETS WILL APPRECIATE IN VALUE--

(IF REVALUED THEIR NTA WILL GO UP)

Possible the biggest beneficiary, OF COURSE

IS THE big landowners in that area. VALUE OF PROPERTIES IN KUANTAN WILL BE GOOD.

PROPERTY MARKET FOR PAHANG WILL BE BOOSTED,AND PASDEC WILL BE TOP BENEFICIARY.

CONTRACTORS AND SUB-CON

WILL NOT UNTUNG MUCH

BECAUSE ECRL - If restarted, will be at a much much lower price.

MARGINS WILL BE LOWER, FURTHER .......GOVERNMENT MAY WANT MORE SUB-CON TO BE INVOLVED,SO MORE SUB-CON FROM EVERY STATE WILL GET A PIECE OF CAKE

THE DISTRIBUTION OF WORKS WILL BE MORE :"FAIRLY"...AS ALL WILL GET SOME "FOODS" IN THIS BIG PROJECT.

Those companies who were in the front running for the ECRL scraps before, may ......NOT BE SELECTED...OR NO LONGER GET THE OPPORTUNITY?

Sunday, March 24, 2019

CIMB

| Stock | [CIMB]: CIMB GROUP HOLDINGS BHD |

| Announcement Date | 13-Mar-2019 |

| Financial Year | 31-Dec-2018 |

| Subject | Second interim dividend |

| Type | Dividend - Normal or Special |

| Description | Single Tier Second Interim Dividend of 12.00 sen per share in respect of the financial year ended 31 December 2018 |

| Amount | RM 0.12 |

| Ex Date | 25-Mar-2019 |

| Entitlement Date | 27-Mar-2019 |

| Payment Date | 24-Apr-2019 |

Sunday, March 17, 2019

DAYANG MENJADI GOYANG-GOYANG--RUN

While the group had posted strong 4Q18 results, which were lifted by lump-sum work orders, Streets believe such outperformance is unlikely to be repeated. Meanwhile, Streets also believe its upcoming corporate exercises could dampen sentiment.

Dayng posted an exceptionally stronger set of 4Q18 results – more than double QoQ from 3Q18, which is typically a stronger quarter, and rebounding from YoY losses in 4Q17. In fact, 4Q18 results were exceptionally strong that it contributed 57% of its full-year FY18 earnings.

Following this, its share price shooting up by 215% since its 4Q18 results announcement last month.

But, is 4Q18 earnings performance sustainable? All of the quarter’s topside maintenance revenue came from “lump-sum” billings, as compared to the more conventional “schedule of rates” billings.

The lump-sum work orders arises when (i) there is a specific or urgent work request from the client for packaged maintenance or overhaul services, as opposed to the more usual scheduled maintenance works, or (ii) successful billings of variation orders. That said, while there is still a possibility for lump-sum work orders in the coming quarters, observers believe it is unlikely that it will be at the record-high levels seen in 4Q18.

In fact, Streets expect 1Q19 to post more “normalised” levels of profits, on the back of it also being a seasonally weaker quarter given the monsoon season.

Under the assistance of the CDRC of Bank Negara Malaysia, Dayang’s 60.5%-owned listed subsidiary Perdana has hinted of an impending comprehensive corporate exercise to be completed within the next 12 months from March 2019.

This is referring to its Proposed Debt Restructuring Scheme (PDRS) for the CDRC, which may include extension of borrowings, disposal of assets, special issues or placement of shares, and rights issue. Depending on the scheme, there may also be a need to further impair the group’s assets.

That said, it is believed that an upcoming comprehensive corporate restructuring may implicate shareholders of Dayang and as taking lessons from other oil and gas companies that had undergone corporate exercises in the past (e.g. SAPNRG, VELESTO), this also may not play well for the stock’s trading sentiment and share prices.

At RM1.20 is based on 1x PBV in-line with its mean valuations.

Tuesday, March 5, 2019

Subscribe to:

Posts (Atom)