LIFE IS BUT A DREAM 人生如梦 LIFE IS BUT A DREAM 人生如梦 LIFE IS BUT A DREAM 人生如梦

Friday, March 30, 2018

Tuesday, March 27, 2018

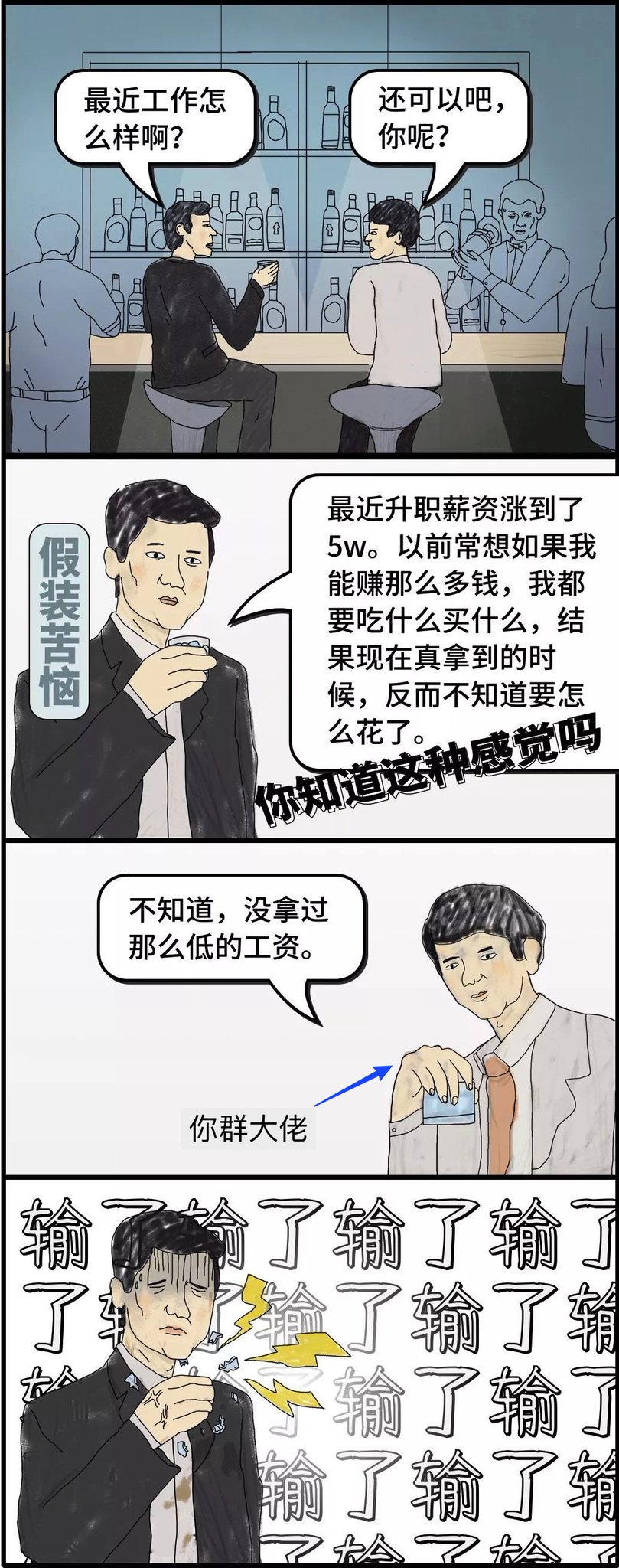

Security is never found in a job, learn how to manage your money wisely. Invest to grow your wealth so much you can walk out of any unpleasant meeting at any time

Security is never found in a job, learn how to manage your money wisely. Invest to grow your wealth so much you can walk out of any unpleasant meeting at any time.

I do that I don’t care how much I can lose or make less. if I don’t like, I just walk out.

HOW SECURE IS YOUR JOB??????BROTHERS

Uber employees in S’pore told to clear out in two hours; drivers in limbo

SINGAPORE — At least 100 Singapore employees of ride-hailing firm Uber were told to pack up and leave on Monday morning (March 26) as a result of rival Grab’s acquisition of its operations in South-east Asia, but Grab clarified hours later that the Uber employees are on paid leave.

VIVOCOM..................亏本。。。。。可怕。。。。很多股友痛苦

Quarterly rpt on consolidated results for the financial period ended 31 Dec 2017

| VIVOCOM INTL HOLDINGS BERHAD |

| Financial Year End | 31 Dec 2017 |

| Quarter | 4 Qtr |

| Quarterly report for the financial period ended | 31 Dec 2017 |

| The figures | have not been audited |

Attachments |

- Default Currency

- Other Currency

Currency: Malaysian Ringgit (MYR)

Definition of Subunit: In a currency system, there is usually a main unit (base) and subunit that is a fraction amount of the main unit.

Example for the subunit as follows:

SUMMARY OF KEY FINANCIAL INFORMATION

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

|

||||

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD |

||

|

31 Dec 2017

|

31 Dec 2016

|

31 Dec 2017

|

31 Dec 2016

|

||

|

$$'000

|

$$'000

|

$$'000

|

$$'000

|

||

| 1 | Revenue |

33,312

|

46,009

|

181,733

|

365,025

|

| 2 | Profit/(loss) before tax |

464

|

738

|

29,160

|

82,579

|

| 3 | Profit/(loss) for the period |

-1,130

|

842

|

20,478

|

65,460

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

-2,635

|

821

|

14,594

|

53,900

|

| 5 | Basic earnings/(loss) per share (Subunit) |

-0.08

|

0.03

|

0.44

|

1.70

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

0.00

|

0.00

|

0.00

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

|

||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

0.1400

|

0.1300

|

||

Definition of Subunit: In a currency system, there is usually a main unit (base) and subunit that is a fraction amount of the main unit.

Example for the subunit as follows:

| Country | Base Unit | Subunit |

| Malaysia | Ringgit | Sen |

| United States | Dollar | Cent |

| United Kingdom | Pound | Pence |

Announcement Info

| Company Name | VIVOCOM INTL HOLDINGS BERHAD |

| Stock Name | VIVOCOM |

| Date Announced | 28 Feb 2018 |

| Category | Financial Results |

| Reference Number | FRA-26022018-00125 |

China asks US to offset trade loss due to metal tariffs

By:

Michelle Zhu

GENEVA (Mar 27):

China asked the US to provide compensation for lost trade due to President Donald Trump’s proposed tariffs on steel and aluminum, in a preliminary step that could lead to a dispute between the two nations at the World Trade Organization.

In two filings with the WTO on Monday, China dismissed the US assertion that the metal tariffs were instituted on national security grounds, arguing instead that they were safeguard measures -- temporary trade restrictions aimed at protecting domestic producers.

China responded to the US action by threatening to impose tariffs on US$3 billion ($3.9 billion) of US imports -- including agricultural, steel and aluminum products -- and its ambassador to the US said all options are on the table, though the Asian nation doesn’t want a trade war.

The levies are expected to affect US$689 million worth of Chinese steel and aluminum exports to the US, according to data published by the Peterson Institute for International Economics.

If the US rejects China’s argument that the measures are safeguards, China may have recourse to ask the WTO to mediate the disagreement in a formal dispute proceeding. China said it reserved the right to file a dispute at a later date, according to the filings.

Separately, the European Union took the first step toward protecting EU-based steel manufacturers on Monday when the European Commission opened a “safeguard” probe into whether the 25% levy on foreign steel imposed last week by Trump is diverting worldwide shipments to the EU market.

The probe marks the defensive part of a three-pronged strategy that the EU has drawn up to respond to the US steel tariff and to a 10% levy on foreign aluminum.

Monday, March 26, 2018

这种股市行情, 还要向股东。。。。伸手拿钱,而且公司面对成本增加、ADDITIONAL COST 就玩死人了。。。。债务多多没有水的地步 。。。。。罗来衰

KUALA LUMPUR (March 26): WCE Holdings Bhd has proposed a renounceable

rights issue of five-year, zero coupon redeemable convertible unsecured

loan stocks (RCULS) and free detachable warrants, in a bid to raise up

to RM417.81 million to fund additional costs of the West Coast

Expressway.

The RCULS are to be issued at 100% of their nominal value at 50 sen each, on the basis of five RCULS for every six existing shares, while one warrant is to be issued for every three RCULS.

The group, in its filing with Bursa Malaysia, said it intends to inject the majority of its proceeds as equity, convertibles and subordinated advances into its 80%-owned subsidiary, West Coast Expressway Sdn Bhd (WCESB).

成本大增,开销太大

The funds will support the additional cost of RM180 million incurred for the construction of the expressway. The cost has risen due to higher actual land acquisition costs as compared to the projected land costs.

This has caused an increase in the project cost to RM6.12 billion from RM5.94 billion, for which WCE signed a concession agreement with the government in January 2013.

Under the agreement, WCE had agreed to fund RM1.2 billion via equity, convertibles and subordinated advances from the shareholders of WCESB, which is now increased to RM1.38 billion.

According to WCE, it has thus far injected RM513.49 million in the subsidiary via a term loan and proceeds raised from various corporate exercises since 2013.

The board intends to fund part of the remaining RM634.44 million via the proposed rights issue, which is targeted to raise between RM256.34 million and RM417.81 million.

It will also fund the balance via the remaining proceeds of RM3.08 million raised from its disposal of 500 million shares in Talam Transform Bhd and an expected RM30 million pending the disposal of an additional 400 million shares in the same company.

债务太可怕, 几时赚得回

"Pending the completion of the proposed rights issue, the company may obtain a bridging loan to facilitate and expedite its equity injection into WCESB," WCE said.

Shares in WCE closed up 1 sen or 0.9% at RM1.12, giving the group a market capitalisation of RM1.12 billion.

The RCULS are to be issued at 100% of their nominal value at 50 sen each, on the basis of five RCULS for every six existing shares, while one warrant is to be issued for every three RCULS.

The group, in its filing with Bursa Malaysia, said it intends to inject the majority of its proceeds as equity, convertibles and subordinated advances into its 80%-owned subsidiary, West Coast Expressway Sdn Bhd (WCESB).

成本大增,开销太大

The funds will support the additional cost of RM180 million incurred for the construction of the expressway. The cost has risen due to higher actual land acquisition costs as compared to the projected land costs.

This has caused an increase in the project cost to RM6.12 billion from RM5.94 billion, for which WCE signed a concession agreement with the government in January 2013.

Under the agreement, WCE had agreed to fund RM1.2 billion via equity, convertibles and subordinated advances from the shareholders of WCESB, which is now increased to RM1.38 billion.

According to WCE, it has thus far injected RM513.49 million in the subsidiary via a term loan and proceeds raised from various corporate exercises since 2013.

The board intends to fund part of the remaining RM634.44 million via the proposed rights issue, which is targeted to raise between RM256.34 million and RM417.81 million.

It will also fund the balance via the remaining proceeds of RM3.08 million raised from its disposal of 500 million shares in Talam Transform Bhd and an expected RM30 million pending the disposal of an additional 400 million shares in the same company.

债务太可怕, 几时赚得回

"Pending the completion of the proposed rights issue, the company may obtain a bridging loan to facilitate and expedite its equity injection into WCESB," WCE said.

Shares in WCE closed up 1 sen or 0.9% at RM1.12, giving the group a market capitalisation of RM1.12 billion.

末次研究所的各个情报人员,在中国整整做了30年剪报,现存资料的时间跨度从1912年一直到1940年,共计20余万页、15万余篇、2亿余字,这些资料都被整合进755个文件专辑里。

日本发动侵华战争期间,曾在中国设立了很多规模庞大、设备精良的情报机构。

末次研究所,就是其中最著名的的一个,也是至今谜团重重,未能全部解密的一个。

尽管挂着“末次研究所”的名字,但是,这里的主要职能不是从事科学研究,而是收集整理情报资料。而情报收集整理的方式,也非常独特——剪报!

不得不佩服日本在间谍战中的细心、耐心和决心,为了研究中国无所不用其极。

末次研究所的各个情报人员,在中国整整做了30年剪报,现存资料的时间跨度从1912年一直到1940年,共计20余万页、15万余篇、2亿余字,这些资料都被整合进755个文件专辑里。

抗日战争胜利后,日本在华势力全面撤离。末次研究所废了这么大力气搜集整理的情报,竟然没有及时撤离,全部由国民党政府接管,由北平移交于南京。解放战争前夕,国民党政府准备将这部末次研究所的资料运往台湾,但是在由南京转移至福州时,因为飞机太小没有带走。

当时接管这批资料事,所有人都被“末次研究所”的资料所震惊。

日本情报人员整理的剪报,全面到令人发指,涉及搭配当时主流和影响力较大的中文报纸,包括《顺天》、《北京》、《北益》、《大公》在内的23种报纸;日本报纸11种,英文报纸4种。

资料体裁不限,有消息、通讯、社论、特稿、文件、译文、传记、史话、论著和漫画,还有调查报告、专家报道、调查统计、秘闻佚事及图片资料等等,几乎每一个有价值的资料,都被保留下来。

而且“总目”、“要目”、“追加”等栏目分类明细,每一篇资料,都会加以分析,对于有问题的信息和情报,都加盖专门刻制的印戳,如“疑点”、“未调查”、“要目追加”、“此项可疑”、“误报”、“重复”……这种工作方式和态度,收集和选编资料的严谨,让我们似乎看到了,末次研究所就是一部由无数情报人员组成的超大型计算机在工作。

这批资料每一个页码上,都有“末次研究所”的字样,这才使得我们知道它们的出处。后来又在资料中,偶然发现了五、六封铅印同样格式的信封,上面注明同一个收信人“末次政太郎”,地址是“北京东城栖凤楼七号”。

令人感到诡异万分的是,所有关于“末次研究所”的信息仅此而已。这个末次研究所何时成立,又是如何运作的?至今没有任何线索。末次政太郎又是谁?这个情报机构,除了剪报还做了哪些事情?

按理说,规模这么大、时间这么长的收集资料,无论是人力和财力,都是极大投入,无论在中日哪一方,都不应该是默默无闻的。然而,末次研究所只留下了这样一堆珍贵历史资料,其他的一切,仍然是谜!

末次研究所,就是其中最著名的的一个,也是至今谜团重重,未能全部解密的一个。

尽管挂着“末次研究所”的名字,但是,这里的主要职能不是从事科学研究,而是收集整理情报资料。而情报收集整理的方式,也非常独特——剪报!

不得不佩服日本在间谍战中的细心、耐心和决心,为了研究中国无所不用其极。

末次研究所的各个情报人员,在中国整整做了30年剪报,现存资料的时间跨度从1912年一直到1940年,共计20余万页、15万余篇、2亿余字,这些资料都被整合进755个文件专辑里。

抗日战争胜利后,日本在华势力全面撤离。末次研究所废了这么大力气搜集整理的情报,竟然没有及时撤离,全部由国民党政府接管,由北平移交于南京。解放战争前夕,国民党政府准备将这部末次研究所的资料运往台湾,但是在由南京转移至福州时,因为飞机太小没有带走。

当时接管这批资料事,所有人都被“末次研究所”的资料所震惊。

日本情报人员整理的剪报,全面到令人发指,涉及搭配当时主流和影响力较大的中文报纸,包括《顺天》、《北京》、《北益》、《大公》在内的23种报纸;日本报纸11种,英文报纸4种。

资料体裁不限,有消息、通讯、社论、特稿、文件、译文、传记、史话、论著和漫画,还有调查报告、专家报道、调查统计、秘闻佚事及图片资料等等,几乎每一个有价值的资料,都被保留下来。

而且“总目”、“要目”、“追加”等栏目分类明细,每一篇资料,都会加以分析,对于有问题的信息和情报,都加盖专门刻制的印戳,如“疑点”、“未调查”、“要目追加”、“此项可疑”、“误报”、“重复”……这种工作方式和态度,收集和选编资料的严谨,让我们似乎看到了,末次研究所就是一部由无数情报人员组成的超大型计算机在工作。

这批资料每一个页码上,都有“末次研究所”的字样,这才使得我们知道它们的出处。后来又在资料中,偶然发现了五、六封铅印同样格式的信封,上面注明同一个收信人“末次政太郎”,地址是“北京东城栖凤楼七号”。

令人感到诡异万分的是,所有关于“末次研究所”的信息仅此而已。这个末次研究所何时成立,又是如何运作的?至今没有任何线索。末次政太郎又是谁?这个情报机构,除了剪报还做了哪些事情?

按理说,规模这么大、时间这么长的收集资料,无论是人力和财力,都是极大投入,无论在中日哪一方,都不应该是默默无闻的。然而,末次研究所只留下了这样一堆珍贵历史资料,其他的一切,仍然是谜!

Friday, March 23, 2018

公司愈是處於困難時期,愈需要員工一起拼搏、打天下,不裁員或加薪之舉對內能安定軍心、提高士氣,對外可趁機宣傳集團形象,效益拔群!複雜的商業理論先不說,只數前線員工返工時條氣Gur啲,笑容好啲,對業務已經有極大影響。

公司愈是處於困難時期,愈需要員工一起拼搏、打天下,不裁員或加薪之舉對內能安定軍心、提高士氣,對外可趁機宣傳集團形象,效益拔群!複雜的商業理論先不說,只數前線員工返工時條氣Gur啲,笑容好啲,對業務已經有極大影響。

| |

Thursday, March 22, 2018

REITS-----real estate in tong sampah......................now???

KUALA LUMPUR (March 21): Share prices of Malaysian Real Estate Investment Trusts (REITs) fell this morning despite a positive market breadth, as cautious investors trimmed positions in a rising interest rate environment.

At the time of writing, Sunway REIT lost as much as 3.8% or six sen to RM1.52, Pavilion REIT declined 2.9% or two sen to a low of RM1.34, while KLCC Property Holdings Bhd inched down 1% or seven sen to RM6.94 thus far.

Industrial-centric Axis REIT slid one sen or 0.8% to a low of RM1.23, while YTL Hospitality REIT and Amanahraya REIT fell as much as 0.9% and 0.6% to RM1.08 and 84.5 sen thus far.

MRCB-Quill REIT too was not spared as it slipped 0.95% or one sen lower to RM1.04 by mid-morning.

A local analyst who declined to be named said some investors are being cautious as they are expecting higher interest rate and a weak distribution per unit (DPU) growth, which both work against REITs whose valuations were not cheap to begin with.

“The rising yield, or lower asset prices, does not go well for REIT prices. Prices needed to fall so that the yield goes higher to attract buyers,"

Tuesday, March 20, 2018

EPF THREW MAH SING.....................

| stock | [MAHSING]: MAH SING GROUP BHD |

| Announcement Date | 20-Mar-2018 |

Substantial Shareholder's Particular:

| Name | EMPLOYEES PROVIDENT FUND BOARD ("EPF") |

Details of Changes:

| Currency | - |

| Date of Change | Type | Number of Shares | |

|---|---|---|---|

| 14-Mar-2018 | Disposed | 1,500,000 | |

| Registered Name | Citigroup Nominees (Tempatan) Sdn Bhd - Employees Provident Fund Board | ||

| Nature of Interest | Direct Interest | ||

| Nature of Interest | Direct Interest |

| Shares | Ordinary Shares |

| Reason | Disposal of shares |

Total no of securities after change

| Direct (units) | 222,419,369 |

| Direct (%) | 9.16 |

| Indirect (units) | 0 |

| Indirect (%) | 0.00 |

| Total (units) | 222,419,369 |

| Total (%) | 9.16 |

| Date of Notice | 19-Mar-2018 |

Thursday, March 15, 2018

Wednesday, March 14, 2018

LION DIVERSIFIED---DELISTING SOON

PRACTICE NOTE 17 / GUIDANCE NOTE 3 : SUSPENSION AND/OR DELISTING

| LION DIVERSIFIED HOLDINGS BERHAD |

| Type | Announcement |

| Subject | PRACTICE NOTE 17 / GUIDANCE NOTE 3 SUSPENSION AND/OR DELISTING |

| Description | LION DIVERSIFIED HOLDINGS BERHAD

SUSPENSION AND DE-LISTING OF THE SECURITIES OF THE COMPANY

|

The Board of Directors of the Company hereby announce that

Bursa Malaysia Securities Berhad ("Bursa Securities") had

vide its letter dated 14 March 2018, informed that the

Company has failed to regularise its condition in accordance

with paragraph 8.04(3)(a) of the Main Market Listing

Requirements of Bursa Securities ("MMLR") where the

Company has failed to submit its regularisation plan to the

Securities Commission or Bursa Securities for approval within

the stipulated timeframe and the Company's application for a

further extension of time to submit the regularisation plan had

been rejected.

In the circumstances and pursuant to paragraph 8.04(5) of the

MMLR, Bursa Securities had informed that:

1. the trading in the securities of the Company will be suspended with effect from 22 March 2018; and 2. the securities of the Company will be de-listed on 26 March 2018 unless an appeal against the de-listing is submitted to Bursa Securities on or before 21 March 2018 ("Appeal Timeframe"). Any appeal submitted after the Appeal

Timeframe will not be considered by Bursa Securities. In the event the Company submits an appeal to Bursa Securities within the Appeal Timeframe, the removal of the securities of the Company from the Official List of Bursa Securities on 26 March 2018 shall be deferred pending the decision on the Company's appeal. With respect to the securities of the Company which are currently deposited with Bursa Malaysia Depository Sdn Bhd ("Bursa Depository"), the securities may remain deposited

with Bursa Depository notwithstanding the de-listing of the securities from the Official List of Bursa Securities. It is not mandatory for the securities of a company which has been de-listed to be withdrawn from Bursa Depository. Alternatively, shareholders of the Company who intend to hold their securities in the form of physical certificates, can withdraw these securities from their Central Depository System (CDS) accounts maintained with Bursa Depository at any time after the securities of the Company have been de-listed from the Official List of Bursa Securities. This can be effected by the shareholders submitting an application form for withdrawal in accordance with the procedures prescribed by Bursa Depository. These shareholders can contact any Participating Organisation of Bursa Securities and/or Bursa Securities' General Line at 03-2034 7000 for further information on the withdrawal procedures. Upon the de-listing of the Company, the Company will continue to exist but as an unlisted entity. The Company is still able to continue its operations and business and proceed with its corporate restructuring and its shareholders can still be rewarded by the Company's performance. However, the shareholders will be holding shares which are no longer quoted and traded on Bursa Securities. The Board will submit an appeal on the de-listing of the securities of the Company and will announce any development in due course. |

|

Announcement Info

| Company Name | LION DIVERSIFIED HOLDINGS BERHAD |

| Stock Name | LIONDIV |

| Date Announced | 15 Mar 2018 |

| Category | General Announcement for PLC |

| Reference Number | GA1-15032018-00029 |

YFG----DELIST ON 26 MARCH 2018........................

Suspension and De-listing of YFG Berhad

| YFG BERHAD |

YFG Berhad (YFG) has failed to regularise its condition in accordance with paragraph 8.04(3)(a) of the Bursa Malaysia Securities Berhad (Bursa Securities) Main Market Listing Requirements (Main LR) where the company had withdrawn the proposed regularisation plan submitted to Bursa Securities and the company’s application for a further extension of time to submit a new proposed regularisation plan had been rejected by Bursa Securities.

In the circumstances and pursuant to paragraph 8.04(5) of the Main LR, please be informed that:-

(a) the trading in the securities of YFG will be suspended with effect from 22 March 2018; and

(b) the securities of YFG will be de-listed on 26 March 2018 unless an appeal against the de-listing is submitted to Bursa Securities on or before 21 March 2018 (“the Appeal Timeframe”). Any appeal submitted after the Appeal Timeframe will not be considered by Bursa Securities.

In the event YFG submits an appeal to Bursa Securities within the Appeal Timeframe, the removal of the securities of the company from the Official List of Bursa Securities on 26 March 2018 shall be deferred pending the decision on the company’s appeal.

With respect to the securities of YFG which are currently deposited with Bursa Malaysia Depository Sdn Bhd (“Bursa Depository”), the securities may remain deposited with Bursa Depository notwithstanding the de-listing of the securities from the Official List of Bursa Securities. It is not mandatory for the securities of a company which has been de-listed to be withdrawn from Bursa Depository.

Alternatively, shareholders of YFG who intend to hold their securities in the form of physical certificates, can withdraw these securities from their Central Depository System (CDS) accounts maintained with Bursa Depository at any time after the securities of the company have been de-listed from the Official List of Bursa Securities. This can be effected by the shareholders submitting an application form for withdrawal in accordance with the procedures prescribed by Bursa Depository. These shareholders can contact any Participating Organisation of Bursa Securities and/or Bursa Securities’ General Line at 03-2034 7000 for further information on the withdrawal procedures.

Upon the de-listing of YFG, the company will continue to exist but as an unlisted entity. YFG is still able to continue its operations and business and proceed with its corporate restructuring and its shareholders can still be rewarded by the company’s performance. However, the shareholders will be holding shares which are no longer quoted and traded on Bursa Securities.

Announcement Info

| Company Name | YFG BERHAD |

| Stock Name | YFG |

| Date Announced | 14 Mar 2018 |

| Category | Listing Circular |

| Reference Number | ILC-14032018-00003 |

Monday, March 12, 2018

Streets are negative on the exercise, as the offer of RM2.56 per share is lower than their existing TP of RM2.70, a 20% discount to Streets estimated SoP (sum-of-parts) of RM3.38 per share and amidst expectations of better earnings prospects ahead.

UMW'S OFFER TAK SEDAP LANGSUNG................

Its

plan to tighten its grip on Perodua may not be smooth sailing simply

because its offer price to take over MBM Resources Bhd, which holds

22.58% stake in Perodua, is viewed as not that attractive.

The

group’s intention to buyout MBM Resources at RM2.56 per share, which is

expected to cost RM501.04 million in total, is hailed as a wise move.

Streets however, concur that it is quite a raw deal for MBM Resources

shareholders.

Streets

are negative on the exercise, as the offer of RM2.56 per share is lower

than their existing TP of RM2.70, a 20% discount to Streets estimated

SoP (sum-of-parts) of RM3.38 per share and amidst expectations of better

earnings prospects ahead.

Streets

reckon the takeover as cheap for UMW to obtains a controlling stake in

Perodua and is unlikely to appear enticing enough for MBM Resources’

minority shareholders to accept.

In

the case that minority shareholders reject the eventual mandatory

offer, things would likely remain status quo for the minorities other

than having a new majority shareholder running the show at MBM.

Also

the offer price valued MBM Resources at a 38% discount to its peers, in

terms of PER. Based on Streets earnings forecast for the financial year

ending Dec 31, 2018 (FY18), the proposed acquisition works out to 10

times the PER which is at a 38% discount to the sector average PER of 16

times.

Bermaz Auto Bhd has a PER of 19.5 times, while Sime Darby Bhd has a PER of 24 times.

In terms of PBV, the acquisition works out to 0.7 times FY18 PBV compared with its five-year historical average of 0.66 times.

Critics

however noted that MBM Resources’ share price performance has not been

encouraging over the years, thus this could be an exit opportunity for

MBM Resources shareholders. The stock has been on a declining trend

since mid-2015, from a high of RM3.74.

Also,

it is worth noting that the share price only surpassed the offer price

in September and October 2016, and has continuously been on a downtrend

since then.

Post acquisition, UMW will have a 70.6% stake in Perodua consisting of a 48% direct interest and 22.6% via MBM Resources.

| Dear valued client,

As announced by Bursa recently, 351 listed companies with market capitalisation ranging between RM200 million and RM2 billion as at Dec 31, 2017, are eligible for waiver of stamp duty effective from Mar 1, 2018. The three-year stamp duty waiver (until 28 Feb 2021) is aimed at boosting trade for small-and mid-cap companies and garnering greater participation from retail investors which have shied away from the local equity market.

Eligibility from 2019 onwards will be based on the market capitalisation of the companies as at Dec 31, 2018, respectively. Please be reminded also that Exchange Traded Fund (ETF) and Structured Warrants are also exempted from stamp duty for 3 years effective 1 Jan 2018 to 31 Dec 2020. The list of eligible listed companies can be found [www.hlebroking.com/v3/Files/UserGuide/user guide pdf/user guide(E)/mail_stock_list.pdf]here. Yours sincerely, HLeBroking.

| ||||||||

Sunday, March 11, 2018

Hot Stock - SAPNRG (Lots of Uncertainties) ...SAPURA ENERGY---WEAK CASH FLOW AND UNCERTAINITIES

Observers pointed to Sapura’s weak cash flow and uncertainties over its order book replenishment.

There

is also speculation of Sapura being removed from [the] MSCI Malaysia

Index as a result of its market cap size may also pose some downside

risks to the share price as foreign shareholding stood at 21% [as of end

January 2018].

Observers

opine Sapura’s E&C and drilling divisions will continue to suffer

from extensive competition and oversupply. One way to stay competitive

[in the E&C segment] is to compromise on margins. That puts pressure

on Sapura’s E&C division, whose margins are still just too thin.

Basically

their results will remain weak for the next few quarters from March

2018. Any new contracts won right now (March 2018) will also require

some time before earnings kick in. And contribution from its E&P

division is not sufficient to offset losses from the other two divisions

in the short run.

Sapura’s

only profitable operation is the exploration and production (E&P)

division whose prospects are improving with the better oil price.

Its

production in the SK310 B15 gas field development project in Sarawak

commenced in 4QFY18. It also has two lucrative fields (SK408 and SK310

B14) in the pipeline, which are expected to provide substantial

contributions beginning 2020.

Profits

aside, news that Sapura is considering listing the E&P division has

failed to boost interest in the stock. After the news was confirmed by

the group’s management on Jan 25 2018, the share sell-off persisted.

Streets

described the potential E&P listing as a double-edged sword. A

potential listing of its E&P business is “positive” in the long run

as it would allow the group to unlock value and not be dragged down by

the existing two business segments. However, this deal also works as a

double-edged sword as believe if carved out completely, the ‘leftover’

Sapura would lose its appeal to many existing investors who believe in

the monetisation potential of its gas fields.

But

the group may have little room to manoeuvre — as at Oct 31, 2017,

Sapura’s short-term borrowings alone amounted to RM15.53 billion.

Thursday, March 8, 2018

美國總統特朗普簽署對進口鋼鋁徵收關稅,加拿大和墨西哥獲得豁免,市場對貿易戰的憂慮稍為紓緩。

美國總統特朗普簽署對進口鋼鋁徵收關稅,加拿大和墨西哥獲得豁免,市場對貿易戰的憂慮稍為紓緩。

美國股市收市向好。道指收報24,895點,升93點;標指收報2,738點,升12點;納指收報7,427點,升31點。

Tuesday, March 6, 2018

EKSONS---VERY BAD RESULT.................PASSAGE TO HOLLAD, TOO

Quarterly rpt on consolidated results for the financial period ended 31 Dec 2017

| EKSONS CORPORATION BERHAD |

| Financial Year End | 31 Mar 2018 |

| Quarter | 3 Qtr |

| Quarterly report for the financial period ended | 31 Dec 2017 |

| The figures | have not been audited |

Attachments |

| Remarks : |

The quarterly report for financial period 31 December 2017 has been reviewed by Company's external auditor. |

- Default Currency

- Other Currency

Currency: Malaysian Ringgit (MYR)

SUMMARY OF KEY FINANCIAL INFORMATION

|

INDIVIDUAL PERIOD

|

CUMULATIVE PERIOD

| ||||

CURRENT YEAR QUARTER

|

PRECEDING YEAR

CORRESPONDING QUARTER |

CURRENT YEAR TO DATE

|

PRECEDING YEAR

CORRESPONDING PERIOD | ||

31 Dec 2017

|

31 Dec 2016

|

31 Dec 2017

|

31 Dec 2016

| ||

$$'000

|

$$'000

|

$$'000

|

$$'000

| ||

| 1 | Revenue |

47,507

|

37,951

|

110,525

|

91,737

|

| 2 | Profit/(loss) before tax |

-4,499

|

1,087

|

-12,858

|

-7,938

|

| 3 | Profit/(loss) for the period |

-4,968

|

672

|

-13,943

|

-8,590

|

| 4 | Profit/(loss) attributable to ordinary equity holders of the parent |

-4,774

|

894

|

-13,303

|

-6,199

|

| 5 | Basic earnings/(loss) per share (Subunit) |

-2.97

|

0.56

|

-8.28

|

-3.85

|

| 6 | Proposed/Declared dividend per share (Subunit) |

0.00

|

0.00

|

0.00

|

0.00

|

AS AT END OF CURRENT QUARTER

|

AS AT PRECEDING FINANCIAL YEAR END

| ||||

| 7 | Net assets per share attributable to ordinary equity holders of the parent ($$) |

2.8100

|

2.8900

| ||

Definition of Subunit:

In a currency system, there is usually a main unit (base) and subunit that is a fraction amount of the main unit.

Example for the subunit as follows:

Example for the subunit as follows:

| Country | Base Unit | Subunit |

| Malaysia | Ringgit | Sen |

| United States | Dollar | Cent |

| United Kingdom | Pound | Pence |

Announcement Info

| Company Name | EKSONS CORPORATION BERHAD |

| Stock Name | EKSONS |

| Date Announced | 28 Feb 2018 |

| Category | Financial Results |

| Reference Number | FRA-28022018-00097 |

Subscribe to:

Posts (Atom)