LIFE IS BUT A DREAM 人生如梦 LIFE IS BUT A DREAM 人生如梦 LIFE IS BUT A DREAM 人生如梦

Monday, October 30, 2017

Friday, October 27, 2017

财政预算案--------- 公务员吃完老本,现在吃GST……!

Voon Chong 成本每一年提高 发展资金却每一年停留

Voon Chong 没办法 ,那些是票选的大仓库

黄文正 公务员吃完老本,现在吃GST……!

张启华 一针见血。

Voon Chong 没办法 ,那些是票选的大仓库

黄文正 公务员吃完老本,现在吃GST……!

张启华 一针见血。

2千800多億,真的是大選預算案....

Monday, October 23, 2017

Friday, October 20, 2017

Thursday, October 12, 2017

'Cautious' - Tasco (Here Comes Uberisation Of Trucking Industry) ...

'Cautious' - Tasco (Here Comes Uberisation Of Trucking Industry) ..

The

Uber platform, which is a ride-sharing application, has transformed the

cab hire market worldwide. A similar application is now being used in

the logistics industry.

In

particular, smaller scale trucking services, which provide faster

delivery with greater convenience to customers, have mushroomed of late;

giving rise to the coining of term ‘uberisation of the trucking

industry’.

明年调高到 RM1200???

(吉隆坡13日讯)根据人力资源部长拿督斯里理察烈,该部将于明年提高最低薪金。

马新社昨日报道,国家薪金理事会已经开始筹划检讨2016年最低薪金指令,以制定大马半岛,沙巴、砂拉越和纳闽的最新最低薪金,然后提呈内阁。

这将是3年来我国第二次调整最低薪金。2016年7月,最低薪金从大马半岛的900令吉,沙巴、砂拉越和纳闽的800令吉,分别调高至1000和920令吉。

马新社昨日报道,国家薪金理事会已经开始筹划检讨2016年最低薪金指令,以制定大马半岛,沙巴、砂拉越和纳闽的最新最低薪金,然后提呈内阁。

这将是3年来我国第二次调整最低薪金。2016年7月,最低薪金从大马半岛的900令吉,沙巴、砂拉越和纳闽的800令吉,分别调高至1000和920令吉。

曾经被大炒。。。。大股东便宜出货。。。。谁说发达很难。。。

Dataprep: Controlling shareholder sells out, buyer makes takeover offer for remaining shares.

A printing and publishing firm acquired Dataprep Holdings’ controlling

shareholder’s entire stake in the loss-making IT solutions provider, and

announced an unconditional mandatory takeover offer for the remaining

shares. Wardah Communication SB acquired the 270.5m shares or 64.2%

stake in Dataprep from VXL Holdings SB at 16 sen a share, Dataprep said.

Wardah’ offer for the remaining shares is being made at the same price

of 16 sen, which represents a 23 sen or 58.97% discount to the group’s

last closing price of 39 sen. (The Edge)

bursahunter only lousy company will sell at discounted price...current market price is a joke for such loss making company...

ilovehits Takeover at $0.16. Who said this DATAPRP worth $1.00 before? Pity to those chase high.

Ninetales This is mega sales... 60% off..!!

datuk lim already know dataprep not worth this much,only money games people push until 70cts.now they gone dataprep also gone

apolloang dataprep NTA only 0.07cts....company almost empty shell one,only pump and dump

Funny is if the share price is close to 40 sen why would someone want to sell it at 16 sen

SORRY

I DO NOT HOLD 1 SINGLE stock in DATAPRP but Itake pity on all those who

do because of this TYPE of dirty busness man tactic

fl888 Datuk

Lim gave this guy a roulette jackpot number, buy 16 sell at 33 , how

much virtual profit in hand, multimillionaire overnight by book value,,,

LUCKY BOY BUY CHEAP-CHEAP.......

谁说发达很难。。。

一转手, 就大赚了。。。

Wednesday, October 11, 2017

For its three months ended March 31, 2017, the group’s net loss narrowed on a quarter-on-quarter basis to RM953,000 with a turnover of RM4.46 million, from a net loss of RM2.07 million in the three months ended Dec 31, 2016, when it clocked in a revenue of RM3.52 million.

KEYASIC - Anything Interesting (Khazanah Holds 23% Stake) !!!

It has been in the red for the last four years (Till end FY2016), is banking on securing recurring sales for its Internet of things or IoT products, which it has spent the last five years developing, to return to profitability, which it expects to happen by the second half of its financial year 2018 (FY18).

The group designs and manufactures chips for IoT products has failed to turn a profit in the last four years because the IoT industry is still new. It takes time [to make a profit] because IoT is at its infancy, not only in Malaysia, but everywhere in the world. It takes a longer time because the end users in the market are usually non-IT users and they do not have the correct infrastructure [yet to make use of its chips].

KeyAsic has invested a large amount, over US$20 million (RM84.4 million) to develop its products.

Among the IoT products the group has developed in the past five years (2012-2017) are its system-in-a package or SiP chip, SPG101, and system components like WiFi SD Card called K-Card, and its wire-less USB flash drive, K-Drive 9.

In May 2017 two more new chips have gone into production, namely its Numeric matrix (NM) CPU and PCI-e SoC (system-on-a-chip), which took four years to develop, with a collective investment of about US$3 million. The chips were co-designed with RC Module, a leading system and chip design company in Russia.

The NM CPU chip, in particular, is involves scientific calculations. [Up until now (end May 2017),] it has been used on much larger scales, such as in satellite and aerospace products, like to track the weather for forecasts, and for image and voice detection.

So far (Till end May 2017), Key Asic has secured RM7 million worth of contracts for the initial shipping and production of the two newer chips, which will see the deployment of 10,000 units of each chip into the market, from which it can gather feedback and work out any logistical issues — a process likely to take at least six months — before recurring sales orders will come in.

After the spate of investment spendings in the last five years, its top officials said the company is now (End May 2017) in a firm footing to court customers. KeyAsic will know if the products can secure recurring sales contracts from its customers, from between the fourth quarter of 2017 to the first quarter of 2018, for all its chips.

For its three months ended March 31, 2017, the group’s net loss narrowed on a quarter-on-quarter basis to RM953,000 with a turnover of RM4.46 million, from a net loss of RM2.07 million in the three months ended Dec 31, 2016, when it clocked in a revenue of RM3.52 million.

There were no year-on-year comparative figures as the group had changed its financial year end from Dec 31 to May 31.

For the quarter ended May 2017, it posted a net loss of RM1.449 million or EPS of 0.17 sens.

As at March 31 2017, the group’s accumulated net loss stood at RM45.28 million.

Malaysia’s government investment arm Khazanah Nasional Bhd remains a substantial shareholder of Key Asic, with a 23% stake as at May 4 2017, while former chairman of China Development Industrial Bank, Taiwanese Benny T Hu @ Ting Wu Hu, has been an independent non-executive director of the group since 2009.

Eg has an indirect interest of 39.06% in Key Asic, together with three others, by virtue of his deemed interest in Key Asic Ltd, the group’s largest shareholder with a 39.06% stake as at April 6 2016.

Eg also has a direct stake of 0.18% in Key Asic.

Tuesday, October 10, 2017

SUNWAY-WB...........GILA SASAU

If my observation of past premium for construction groups holds true,

the current price of Sunway-WB can only sustain if Sunway share price

were to rally strongly & quickly. Otherwise the price of Sunway-WB

will likely come down. If you have this warrant, it is advisable to take

some profit soon.

http://nexttrade.blogspot.my/2017/10/sunway-wb-such-high-premium.html

http://nexttrade.blogspot.my/2017/10/sunway-wb-such-high-premium.html

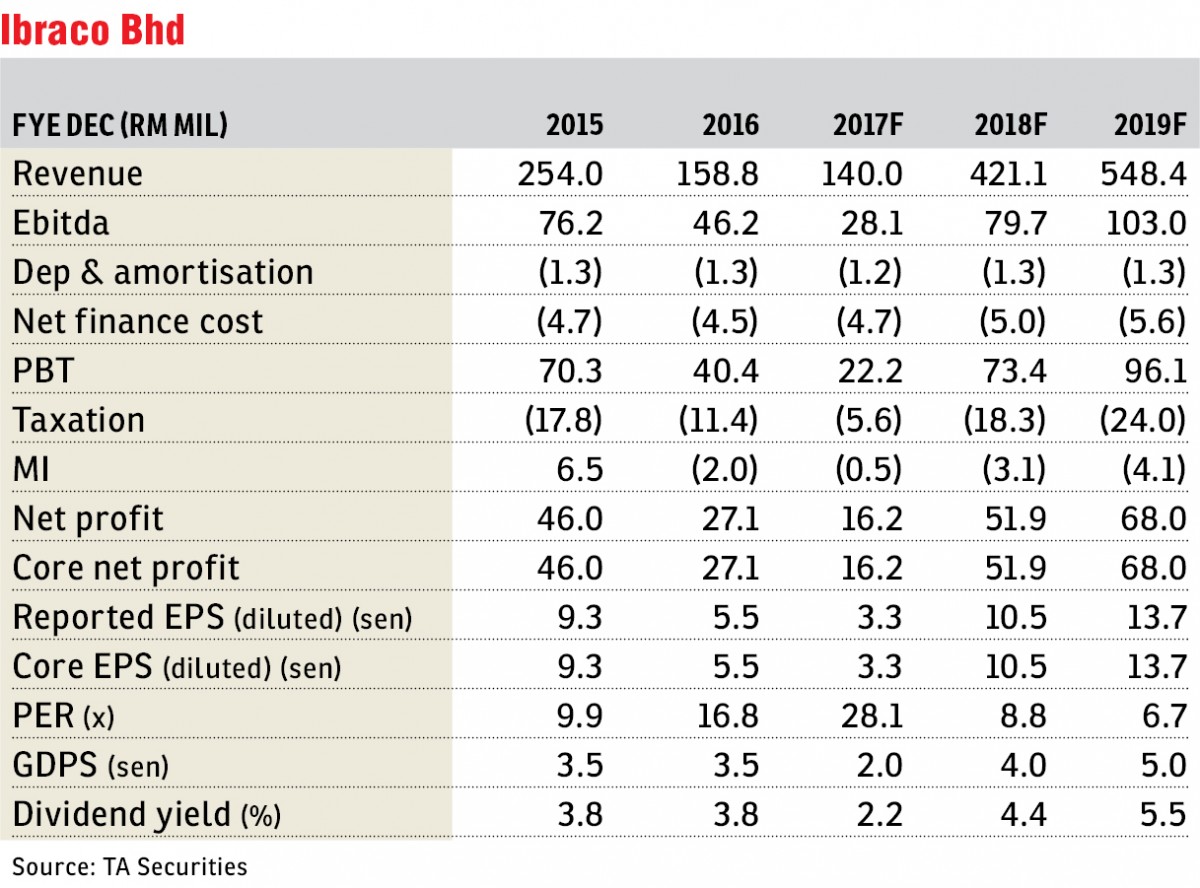

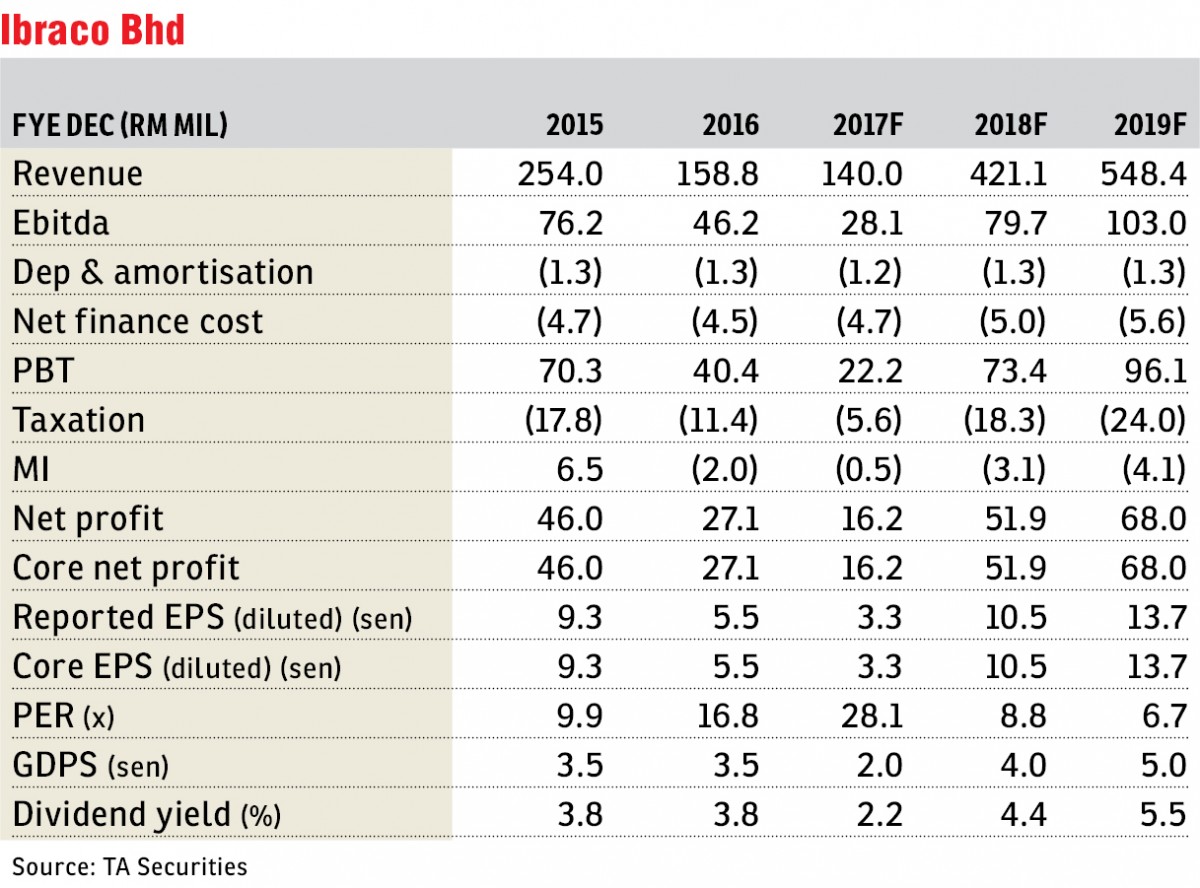

Ibraco pins its future on a strong capital position

Reiterate hold with an unchanged target price of 94 sen: In February, Ibraco Bhd unveiled its first property development outside Sarawak, namely The Continew (GDV: RM415 million) in Kuala Lumpur. It is a mixed development featuring four units of three-storey commercial shop/retail outlets, 30 units of retail/office space and 510 serviced apartments. Priced at RM900 psf, we note it is attractive as compared to surrounding projects that are generally priced at RM1,000 psf onwards.

In terms of take-up rate, we gather that it is now 49% sold. In September, Ibraco proposed to buy four parcels of vacant leasehold land in Petaling Jaya, Selangor, for RM37.4 million (or RM220 psf) to further build up its presence in the Klang Valley. Measuring a total of 15,811.16 sq m, the land is strategically located along the New Pantai Expressway.

On the construction front, the group has secured a contract to build a new airport in Mukah, Sarawak, for RM302.6 million in July. Note that the airport job is only the second public construction contract Ibraco has won since the construction unit was set up in 2002.

Besides construction and property development, it has recently ventured into another new segment — education services. Last week, the group announced that it has teamed up with HELP Education Services Sdn Bhd to offer education at the primary, secondary and pre-university levels.

For a start, we understand that the group will allocate approximately RM55 million to RM60 million for this new business segment over a development period of two years. We believe that this would diversify the group’s source of income as well as enhance the value of its upcoming launches within its new township, Northbank, in Kuching. Ibraco is working with HELP to set up an education centre in the development.

https://www.edgeprop.my/content/1209257/ibraco-pins-its-future-strong-capital-position

Monday, October 9, 2017

MEDIA PRIMA, STAR...............HOPELESS EVEN PUSHING HARD BY MORGAN STANLEY

Now, if I want to ask. Do you bother to reach out to newspaper the first

thing you wake up? Berita Harian, NST, Star or would any person who is

below 50 be reaching out to their mobile phone. Remember, 20 years ago

it was a very different world.

The gist of thing is that if one wants to get people to push up Media Prima shares - why don't promote something else - as this stock could be a really painful stock to own.

http://www.intellecpoint.com/2017/10/are-you-buying-media-prima-seriously.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FIFWDU+%28SERIOUS+investing%29

The gist of thing is that if one wants to get people to push up Media Prima shares - why don't promote something else - as this stock could be a really painful stock to own.

http://www.intellecpoint.com/2017/10/are-you-buying-media-prima-seriously.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FIFWDU+%28SERIOUS+investing%29

Tuesday, October 3, 2017

Monday, October 2, 2017

In a filing with Bursa Malaysia, LCT said the order from the DOE was issued on Oct 1. LCT added that the company was attending to remedial actions and will provide an update in due course.

KUALA LUMPUR (Oct 2): Lotte Chemical Titan Holding Bhd (LCT) has received a stop-work order from the Department of Environment (DOE) on its KBR Catalytic Olefins Technology catalytic cracking reactor (K-COT) within its TE3 Project for the company, to mitigate and reduce odour emission and eliminate surface oil sheen/film discharge.

In a filing with Bursa Malaysia, LCT said the order from the DOE was issued on Oct 1. LCT added that the company was attending to remedial actions and will provide an update in due course.

Sunday, October 1, 2017

Subscribe to:

Comments (Atom)