Horse-trading, money changes hands, contracts finalising, projects reviewing and the list goes on. That’s what is happening now, as the mother of all scandal – 1MDB – about to enter another new month this year. Bets are on the table that by hook or by crook, prime minister Najib Razak and his wife Rosmah Mansor may have a smooth sailing after all.

In fact, Najib and Auntie Rosy are ready to pull Mahathir and his family down together, if that’s what it will take to win this war. Clearly, only one team will emerge victorious, and the loser will not be able to get a “face-saving” exit this time. With the present social networking age, the loser will be remembered in a disgraceful manner.

What’s rather amazing is the fact that Bank Negara (Central Bank) governor Zeti Akhtar Aziz was the only individual who had not spoken about 1MDB scandal, until today, despite the institution being dragged into the drama by Najib numerous times. First, Najib cried 1MDB money couldn’t be repatriated back home because the central bank would make a big issue out of it.

Subsequently, Najib bitched that BRIM, a project where Santa Claus gives away free cash to people, was actually an idea from the central bank, not from his administration. Still, Zeti didn’t raise a finger but kept an elegance silence, as if she was sleeping on the job. Today, she finally opens her mouth.

Apparently, Zeti had received a report from MAS (Monetary Authority of Singapore) about an account linked to the debt-ridden strategic investment firm at the Swiss-based BSI Bank. As expected, she wouldn’t reveal anything, using “confidentiality” as the excuse. Governor Zeti should know better than anyone else about “helping” Najib Razak, so let’s hope she doesn’t do something stupid.

Besides forming alliances and recruiting betrayals, this war of the century – Mahathir vs Najib – will see losers being wiped out not only from the political landscape, but also about business cronies losing everything. Hence, the stake is not merely RM42 billion of 1MDB debt alone, but billions of new business contracts.

Like it or not, this “Clash of the Titans” does not only affect politicians and businessmen, but also small investors such as stock market traders, speculators, gamblers, punters or whatever name you wish to call yourself. If Najib wins, the status quo remains. But if he losses, which is very likely, you may want to avoid certain stocks or companies related to his cronies.

Could that be one of the reasons why his own brother, Nazir Razak, appears to be on the enemy’s camp? Actually, it makes perfect sense to distance himselffrom big brother Najib. The stake is simply too high. It’s a foolish move to defend his own brother, and in the process losses everything in CIMB, the same way Rashid Hussein lost RHB because he aligned himself with Anwar Ibrahim.

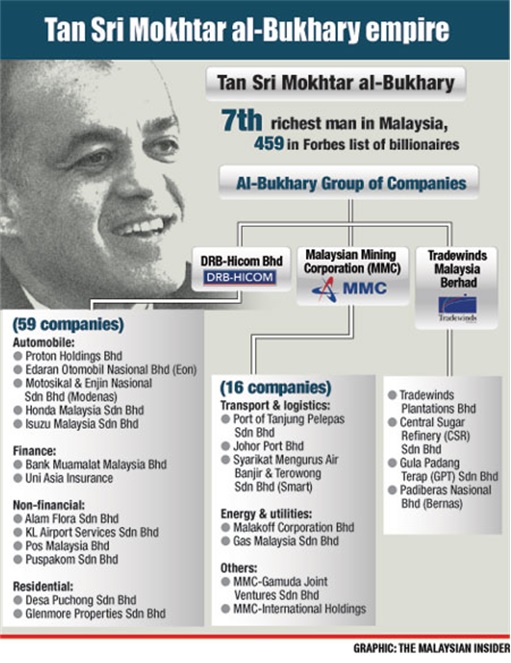

Get ready for a super lengthy write-up on Najib Razak’s cronies below. This is not a complete list though. But some cronies such as Vincent Tan (Berjaya Group), Quek Leng Chan (Hong Leong Group), Teh Hong Piow (Public Bank Berhad), Syed Mokhtar Al-Bukhary, Ananda Krishnan are considered as UMNO-cronies, not Najb-cronies.

{ 1 } Nazir Razak, 49

- CIMB Group Holdings Berhad (KLSE:CIMB, stock-code 1023): Chairman

- Khazanah Nasional Berhad (KNB): Director

- Employees Provident Fund (EPF): Chairman of the Investment Panel Risk Committee

- Malaysia International Islamic Financial Centre: Executive Committee member

Nazir Razak, the youngest brother, is the most well known. He obtained a Master of Philosophy at Cambridge University. He is a career banker, joining CIMB Investment Bank almost 20 years ago and rising through its executive ranks to become its CEO in 1999. Perhaps the most business-savvy within the Razak family members, Nazir is infamous for his controversial acquisition of Southern Bank from owner Tan Teong Hean.

Nazir Razak, the youngest brother, is the most well known. He obtained a Master of Philosophy at Cambridge University. He is a career banker, joining CIMB Investment Bank almost 20 years ago and rising through its executive ranks to become its CEO in 1999. Perhaps the most business-savvy within the Razak family members, Nazir is infamous for his controversial acquisition of Southern Bank from owner Tan Teong Hean.

Following the merger of CIMB and Bumiputra-Commerce Bank, to become Bumiputra-Commerce Holdings Bhd (BCHB), Nazir became CEO of the merged group and later Chairman of CIMB Group. Informed observers widely believeNazir advises Najib on finance and economic policy issues. However, the relationships between all the Razak brothers with PM Najib are in a bad shape due to wife Rosmah Mansor.

{ 2 } Ahmad Johari Razak, 59

- Ancom Berhad(KLSE: ANCOM, stock-code 4758): Non-Executive Chairman

- Hong Leong Industries Berhad(KLSE:HLIND, stock-code 3301): Non-Executive Director

- Daiman Development Berhad(KLSE: DAIMAN, stock-code 5355): Non-Executive Chairman

- Sumatec Resources Berhad (KLSE: SUMATEC, stock-code 1201): Non-Executive Director

- Malaysian Resources Corporation Berhad (KLSE: MRCB: stock-code 1651): Independent Director

- Deutsche Bank (Malaysia) Berhad: Director

- Daiman Golf Berhad: Non-Executive Director

- Courts Mammoth (M) Berhad (delisted-privatised): Non-Executive Chairman

Johari Razak, the second eldest brother and a close friend of Perak Sultan Nazrin Shah. He is a lawyer and senior partner at Shearn Delamore & Co, a large law firm located at Wisma Hamzah-Kwong Hing, Kuala Lumpur. His areas of practice include corporate and commercial joint ventures, mergers and acquisitions; corporate restructuring; and the listing of public companies.

He was believed to play a vital role during the 2009 Perak constitutional crisis,which saw the collapse of Pakatan Rakyat state government. This enabled brother Najib Razak scored important brownie points, as a great political tactician, at least in the eyes of UMNO members.

Coincidently, 1MDB, currently in hot soup over RM42 billion debt scandal, had lendings from a consortium of six foreign banks led by Deutsche Bank. With the prospect of 1MDB declares a default over the syndicated loan amounting to US$975 million, Deutsche Bank Singapore and other banks such as BSI Singapore, RBS Coutts could seek early repayment.

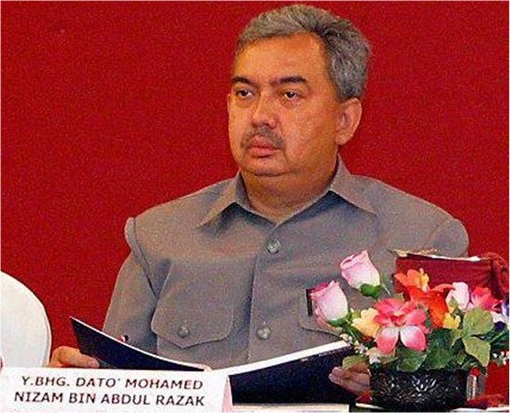

{ 3 } Mohamed Nizam Razak, 56

- Mamee Double-Decker (M) Berhad (delisted-privatised): Non-Executive Director

- Yeo Hiap Seng (M) Berhad (delisted-privatised): Non-Executive Director

- Other directorship: Synergy Track Sdn. Bhd., Deutsche Bank (Malaysia) Bhd., Noah Foundation, Hong Leong Foundation, National Children Welfare Foundation, Yayasan Rahah, and Yayasan Wah Seong.

Nizam Razak studied politics, philosophy, and economics at Oxford University. He was a stockbroker and CEO of PB Securities Sdn Bhd in the 1990s. He is currently a non-executive director in several once-publicly listed companies including Mamee Double-Decker (M) Bhd and Yeo Hiap Seng (M) Bhd, which have since been taken private.

He used to serve as non-executive director at Hiap Teck Venture Bhd and Delloyd Ventures Bhd, and like brother Johari, Nizam is also a director of Deutsche Bank. Together with UMNO money carrier Syed Mokhtar they were once eyeing for the 19.4% stake in DRB-Hicom held by the family trust of late Yahaya Ahmad. Today, Syed Mokhtar owns DRB.

{ 4 } Mohamed Nazim Razak, 53

- Hong Leong Bank Berhad(KLSE: HLBANK, stock-code 5819): Non-Executive Director

- Hong Leong Capital Berhad (KLSE:HLCAP, stock-code 5274): Non-Executive Director

- XiDeLang Holdings Limited (KLSE: XDL, stock-code 5156): Deputy Chairman

- 7-Eleven Malaysia Holdings Berhad (KLSE: SEM, stock-code 5250): Non-Executive Director

- Hong Leong Islamic Bank Berhad: Non-Executive Director

- Other directorship: The Legends Golf & Country Resort Bhd., Batu Caves Centrepoint Sdn. Bhd., BTS Land Capital Sdn. Bhd., Century Tower Industries Sdn. Bhd., Digiport (M) Sdn. Bhd., etc

Nazim Razak, the fourth brother who married former host of TV3’s Nona show, Norjuma Habib Mohamed, studied architecture in the UK. He is Chairman of Meru Utama Sdn Bhd, an outdoor advertising company that received a seven-year advertising concession in 2007 to advertise the Kuala Lumpur International Airport and Low-cost Carrier Terminal (LCCT).

Nazim is also a director of Eng Wah Organization Limited, a Singapore-based business involved in cinema operations, film distribution and rental of retail and office space. He is a Chairman of the Governing Council of Masterskill, a private University/College (the Pro Chancellor is Raja Azureen Raja Azlan Shah, the daughter of the late Sultan of Perak) and Director of OYL Industries (a subsidiary of Hong Leong Group of Companies).

{ 5 } Tan Kay Hock, 67

- Johan Holdings Berhad(KLSE: JOHAN, stock-code 3441): Chairman and CEO

- George Kent (M) Berhad(KLSE:GKENT, stock-code 3204): Chairman

- Jacks International Limited: Chairman

- Iskandar Regional Development Authority: Member

- Malaysian Humanitarian Foundation: Director

When Tan Kay Hock, a golfing buddy of Prime Minister Najib Razak, was awarded the systems work for the RM1.1 billion Ampang light rail transit (LRT) line extension project in July 2012, it raised eyebrows because the company was better known as manufacturers and suppliers of water meters. Mr Tan denied his company, George Kent, won due to political links.

Now that his golfing buddy Najib is in hot soup over 1MDB’s RM42 billion debt scandal, will the prime minister expedite the Kuala Lumpur-Singapore High Speed Rail project before getting the boot? Most importantly, will Tan Kay Hock’s 25-years of “friendship” with Najib helps George Kent secure the jewel of rail projects?

{ 6 } Shahril Shamsuddin, 54

- SapuraKencana Petroleum Berhad(KLSE: SAPCRES, stock-code 8575): Executive Director and President and Group CEO

- Sapura Industrial Berhad(KLSE: SAPIND, stock-code 7811): Deputy Chairman

- Sapura Resources Berhad(KLSE: SAPRES, stock-code 4596): Non-Executive Director

- Sapura Secured Technologies Sdn. Bhd. (private division of Sapura Group): President and CEO

Shahril Shamsuddin of Sapura Group and his family is well known to have avery good relationship with Najib’s family. His father, Shamsuddin Abdul Kadir, the founder of Sapura Group, was however aligned to former premier Mahathir Mohamad. Later, the merger between Mahathir’s son (Mokhzani Mahathir) Kencana Petroleum and SapuraCrest Petroleum forming today’s SapuraKencana in 2012.

However, both Mokhzani and Shahril couldn’t see eye to eye, due to differences of opinion between both co-founders in the running of SapuraKencana, not to mention about who really has better capability helming the country’s largest oil and gas services firm. Subsequently, Mokhzani resigned as vice chairman this year (March 2015).

{ 7 } Mohamed Azman Yahya, 51

- SymphonyHouse Berhad (KLSE: SYMPHNY, stock-code 0016): Group CEO, Founder

- Symphony Life Berhad(KLSE: SYMLIFE, stock-code 1538): Executive Chairman

- Scomi Group Berhad(KLSE: SCOMI, stock-code 7158): Non-Executive Director

- PLUS Expressway Berhad(delisted in 2012): Non-Executive Director

- Ekuiti Nasional Berhad: Director

- AIA Group Limited: Non-Executive Director

- Khazanah Nasional Berhad (KNB): Director

Mohamed Azman Yahya, director of Khazanah, and founder and group chief executive officer of Symphony House Bhd, an outsourcing firm. He is also the ex-CEO of Pengurusan Danaharta Bhd and sits on several advisory panels for the development of the capital market, venture capital, and public service delivery system.

Despite his supposedly wide experience in charge of national asset management, he couldn’t do anything to help the once rotting Malaysian Airline Systems. However, Azman Yahya, one of Najib’s six trusted individuals, was allegedly conspired with Nor Mohamed Yakcop and cheated Halim Saad in a UEM-Renong takeover deal back in 2001.

{ 8 } Rohana Mahmood, 61

- Paramount Corporation Berhad(KLSE: PARAMON, stock-code 1724): Non-Executive Director

- AMMB Holdings Berhad(KLSE: AMBANK, stock-code 1015): Non-Executive Director

- Sime Darby Berhad(KLSE: SIME, stock-code 4197): Non-Executive Director

- RM Capital Partners Sdn Bhd (spin off from Ethos Capital): Chairman and Founder.

- AmInvestment Bank Berhad: Non-Executive Director

Rohana was the chairman and co-founder of Ethos Capital, a RM200 million private equity firm, which through its Ethos Consulting was involved in the National Automotive Policy that resulted in the abuse of APs to selected individuals associated to Khairy Jamaluddin, son-in-law of former prime minister Abdullah Badawi. Among all cronies, Rohana Mahmood stands out as deeply embedded in the Najib family’s commercial interests.

Together with Omar Mustapha Ong, a former special assistant to Najib Razak, they once had their eyes on EPF’s RM300 billion fund to manage. She and another close aide of Najib, Abdul Razak Baginda (linked to gruesome murder of Mongolian Altantuya), are co-founders of an independent think-tank, Malaysian Strategic Research Centre. Najib was chairman of the think-tank, now disbanded.

{ 9 } Azman Mokhtar, 54

- Axiata Group Berhad (KLSE: AXIATA, stock-code 6888): Chairman and Non-Executive Director

- Khazanah Nasional Berhad (KNB): Managing Director and CEO

- Iskandar Investment Berhad: Chairman

Azman was Managing Director and co-founder of the infamous consulting firm BinaFikir, which proposed WAU (Wide Unbundling Asset) in 2002 to save ailing Malaysian Airline System (MAS). Amusingly, under his poor leadership, MAS made bigger losses. Azman then proposed Penerbangan Malaysia Berhad (PMB), which also lost money.

Azman Mokhtar, who is running Khazanah, Malaysia’s sovereign wealth fund which in effect controls CIMB along with the country’s national pension scheme, is one of six trusted individuals personally picked by Najib for ideas on issues ranging from economy, capital markets and general business soon after Najib was appointed Finance Minister.

Comically, the supposedly genius Azman Mokhtar couldn’t turn around MAS for the second time, in a MAS-AirAsia share swap exercise. He probably has the longest list of “failed” restructuring and business ventures - tuna fishing venture losses of RM120 million, Parkway Holdings’ RM935 million losses, and whatnot.

{ 10 } Mohd Nadzmi Mohd Salleh, 61

- Konsortium Transnasional Berhad(KLSE: KTB, stock-code 4847): Chairman and Managing Director

- Transocean Holdings Berhad(KLSE: TOCEAN, stock-code 7218): Chairman and Managing Director

- V.S. Industry Berhad(KLSE: VS, stock-code 6963): Non-Executive Director

- JT International Berhad: Chairman

- Express Rail Link Sdn Bhd (ERL): Chairman

- Nadicorp Holdings Sdn Bhd: Chairman

- Trisilco Folec Sdn Bhd: Chairman

Mohd Nadzmi, the chairman and MD of express bus operator, Konsortium Transnational Bhd. The former Proton boss was called upon by the Government in 1996 to revive the ailing public transport company. He is one of the six trusted individuals personally picked by Najib for ideas on issues ranging from economy, capital markets and general business soon after Najib was appointed Finance Minister.

He was former PM Mahathir’s prodigy and has expertise in transportation. Nadzmi had tried bidding for Proton numerous times, when the national car maker’s profits came under pressure. German’s Volkswagen and American’s General Motors had held talks with Proton management but the sensitive issue of “over-protection” ownership hindered any further strategic alliance.

{ 11 } Mohd Salleh Bakke, 61

- Sime Darby Berhad(KLSE: SIME, stock-code 4197): President, Group CEO

- Eastern & Oriental Berhad(KLSE: E&O, stock-code 3417): Non-Executive Director

- Sime Darby Property Berhad: Non-Executive Director

- Yayasan Sime Darby: Non-Executive Director

- Northern Corridor Economic Region (NCER): Director

- Other directorship: Sime Darby Energy & Utilities Sdn. Bhd., Sime Darby Healthcare Sdn. Bhd., Sime Darby Plantation Sdn. Bhd., Sime Darby Industrial Holdings Sdn. Bhd., Sime Darby Bhd., Eastern & Oriental Bhd., Sime Darby Energy Sdn. Bhd., Sime Darby Motors Sdn. Bhd.

Bakke was formerly the Group President & Chief Executive Officer of Felda Global Ventures Holdings Berhad. His previous directorship and chairmanship involvement included Permodalan Nasiona Berhad (PNB), Pengurusan Danaharta Nasional, Bank Islam Malaysia, Lembaga Tabung Haji and whatnot.

But none of the above beats his latest “involvement”, or at least his “knowledge” about the explosive 1MDB’s RM42 billion debt. Bakke was thechairman of 1MDB from 11-Aug-2009 till his resignation on 19-Oct-2009. So, was he involved in the approval of US$700 million, allegedly siphoned to Good Star Ltd, a company owned by Jho Low?

{ 12 } Lodin Wok Kamaruddin, 61

- Affin Holdings Berhad(KLSE: AFFIN, stock-code 5185): Deputy Chairman

- Boustead Heavy Industries Corporation Berhad (KLSE:BHIC, stock-code 8133): Chairman

- Boustead Holdings Berhad (KLSE:BSTEAD, stock-code 2771): Deputy Chairman and Group Managing Director

- Boustead Plantations Berhad (KLSE:BPLANT, stock-code 5254): Vice Chairman

- Pharmaniaga Berhad (KLSE:PHARMA, stock-code 7081): Chairman

- 1Malaysia Development Berhad (1MDB): Chairman

- Lembaga Tabung Angkatan Tentera (LTAT): Chief Executive

- Other directorship: UAC Berhad, MHS Aviation Berhad, FIDE Forum, Badan Pengawas Pemegang Saham Minority Berhad, Affin Bank Berhad, Affin Islamic Bank Berhad, Affin Hwang Investment Bank Berhad and AXA Affin Life Insurance Berhad.

The mention of LTAT and Boustead will easily give away the type of business Lodin specialises in. He’s essentially the “Chief of the Armed Forces Fund Board”, making him very powerful and super rich. His Boustead Heavy Industries was notorious for getting all the contracts building military ships for the government, but can never delivered them (*grin*). But that was just the tip of an iceberg.

What many didn’t realise was the fact that Lodin Wok was one of the directors of Perimekar Sdn Bhd until 2010, when the explosive procurement of two French-made submarines was revealed. The Scorpene scandal, which involved RM534.8 million in commission, and later the gruesome murder of Mongolian Altantuya speaks volumes about Lodin’s relationship with Najib. He also sits on the boards of Affin Bank Bhd, one of Perimekar’s bankers.

{ 13 } Ismee Ismail, 51

- Syarikat Takaful Malaysia Berhad(KLSE: TAKAFUL, stock-code 6139): Chairman

- TH Plantations Berhad(KLSE: THPLANT, stock-code 5112): Non-Executive Director

- BIMB Holdings Berhad(KLSE: BIMB, stock-code 5258): Non-Executive Director

- Bank Islam Malaysia Berhad: Non-Executive Director

- Edra Global Energy Berhad (formerly known as 1MDB Energy Group Berhad): Director

- Lembaga Tabung Haji: Group Managing Director and CEO

- 1Malaysia Development Berhad (1MDB): Director

Ismee Ismail began his career at Arab Malaysian Development Berhad in 1987. He later joined the Shell Group of Companies in Malaysia and held various positions including the Head of Forex and Banking of Shell Malaysia Ltd and Group Accountant of Shell Malaysia Trading Sdn. Bhd.

He is currently the Group Managing Director and Chief Executive Officer ofLembaga Tabung Haji. Prior to that, he was the Chief Executive Officer of ECM Libra Securities Sdn Bhd and a Director of ECM Libra Capital Sdn Bhd. What’s in the limelight now is the prospect of Tenaga Nasional Berhad bailing Edra Global Energy Berhad, to the tune of RM16 billion. Did he also has his hand in Tabung Haji’s recent acquisition of 1MDB’s lands?

{ 14 } Robert Kuok Hock Nien, 92

- PPB Oil Palms Bhd (KLSE: PPB, stock-code 4065)

- Malaysian Bulk Carriers Berhad (KLSE:MAYBULK, stock-code 5077)

With net worth of US$12.4 billion (Forbes, May 2015), the world’s #110 richest but Malaysia’s richest man, Robert Kuok is a legend. His empire – Kuok Group – controls a fleet of listed companies in Hong Kong, Singapore and Malaysia. PM Najib Razak used to visit “Uncle Kuok”, who was a childhood friend with second prime minister Tun Razak.

Together with third PM Hussein Onn, the trio’s friendship went back to their school days at Raffles School Singapore. Interestingly, Singapore’s first prime minister - Lee Kuan Yew – was one of their classmates. Although Robert Kuok has brilliantly diversified most of his fortune out of Malaysia, there’re still some “leftovers”.

{ 15 } Other Public-Listed Companies / Financial Institutions

- Tenaga Nasional Berhad (KLSE: TENAGA, stock-code 5347):- possibility of bailing out 1MDB’s Edra Global Energy Berhad to the tune of RM16 billion

- Employees Provident Fund’s (EPF):- RM200 million bond investment in 1MDB; RM1.5 billion investment in Panglima Power Sdn Bhd (PPSB)and Jimah Energy Ventures Sdn Bhd (JEV).

- Retirement Fund Inc. (KWAP):- Invested RM1.4 billion in 1MDB’s various subsidiaries: Bandar Malaysia Sdn Bhd, 1MDB Energy Limited, 1MDB Global Investment Limited, and Jimah Energy Ventures Sdn Bhd (JEV). There was also the controversial sale and leaseback of a commercial office tower with 1MDB Real Estate Bhd (1MDB RE)

- Lembaga Tabung Haji:- has invested RM920 million bond in 1MDB’s real estate development Bandar Malaysia and last month, bought 0.63ha from the Tun Razak Exchange (TRX) financial district.

No comments:

Post a Comment